- Better manage your specific tax situation or complete a high level check to confirm your tax software or paid return was completed correctly.

- Consider upgrading should you wish to use more frequently without ads.

- You do not need to be a CPA or Enrolled Agent to understand how to use this tax calculator.

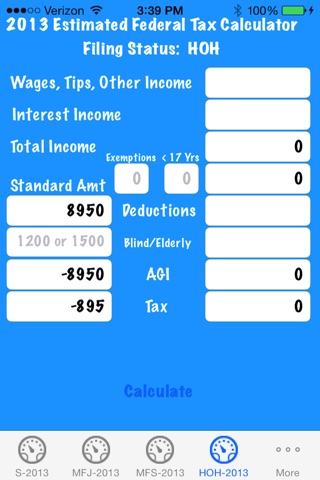

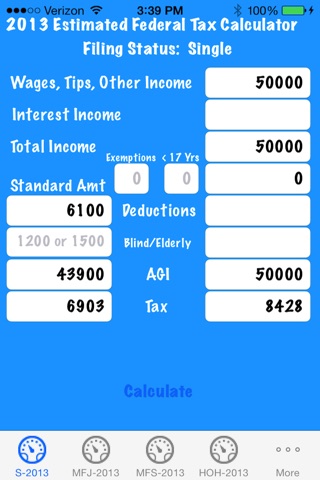

- Just select your filing status, input your income, exemptions and estimated deductions to quickly assess your tax liability for 2012. Note: 2011 is also included should you need to file an amended tax return for any reason.

*** Federal Taxes are due to be filed on or before April 15, 2013 ***

- Quickly and easily calculate Short and Long Term Capital Gains or Losses to assess the effect on your return. Note: The G/L Calculator is separate and any adjustments to income or taxes should be taken into consideration when reviewing your situation in aggregate.

- Compare your Federal Income Tax Liability using both Standard and Itemized deductions to determine the most favorable filing approach for your specific situation.